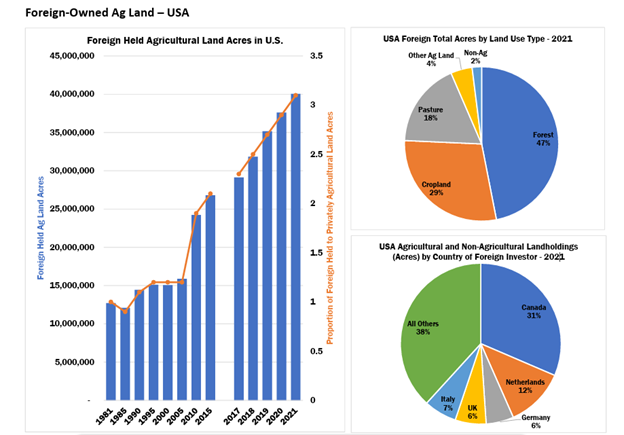

In recent years, the U.S. government has become increasingly concerned about foreign ownership of agricultural land. According to the most recent U.S. Department of Agriculture (USDA) report, foreign owners (primarily Canadian) hold an interest in nearly 45 million acres of U.S. agricultural land.